rhode island sports betting tax

Best of 7 series price. Rhode Island Sports Betting Revenue.

Casino Trade Group S Verdict On Effort To Exclude College Games From Mass Sports Betting Bill The Boston Globe

When it comes to taxes Rhode Island has adopted a revenue-sharing framework with the commercial casino operators.

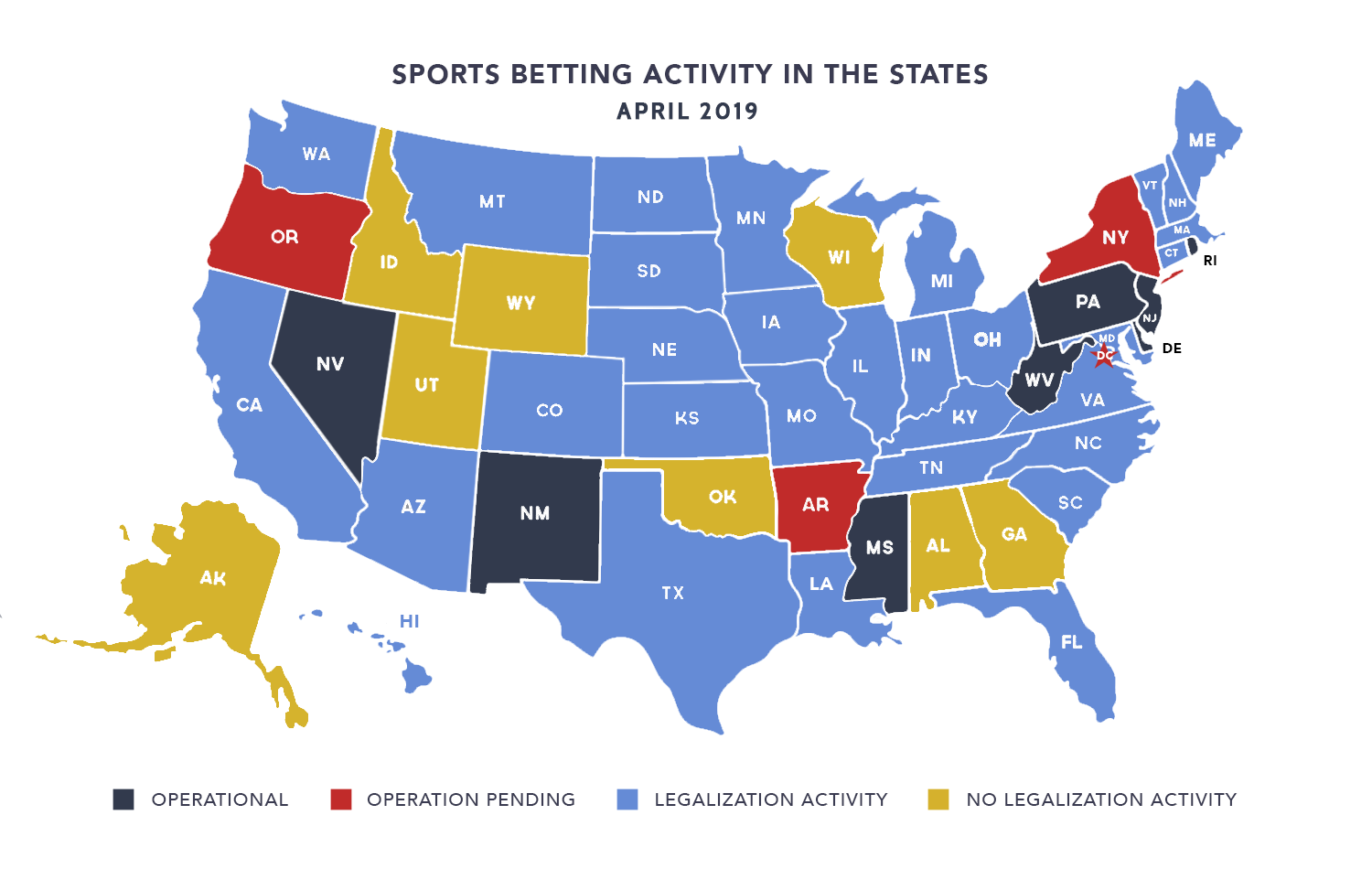

. Quick and Easy Payouts. The state-sanctioned supplier of the betting systems and software gets a 32 cut while the host facilities receive 17. Sports betting is now legal in West Virginia Mississippi New Jersey Pennsylvania and Rhode Island.

Heres a recap of Rhode Islands road to legal sports betting. Individual income tax in the state ranges from 375 to 599. If Rhode Island werent the smallest state in the country and 45 th in terms of population its largesse tax rate would get a lot more attention.

Online and mobile betting was legalized in 2019 with an in-person registration stipulation. When sports betting in Rhode Island players must pay a 599 gambling tax on all winnings. When Governor Gina Raimondo put pen to paper at noon on Friday signing S7200A she made RI sports betting legal.

The state receives 51 of the sports betting revenue generated online or at retail locations. Rhode Island has faced questions about its economic modeling for sports betting since it launched with a colossal 51 state tax rate on the Sports Bet Rhode Island app the highest in the nation. June 22 2018.

The two casinos in the state Twin River Casino and Tiverton Casino are the only licensed sportsbooks in the state and it doesnt look like this will change anytime soon. Rhode Island pursues expanding its sports betting options. Land-based sports betting has been legal in the US.

Governor Raimondo approves sports betting in Rhode Island by signing bill S 2045 into law. For more information you can read our in-depth overview of US gambling taxation. It is also a 644 increase from august 2019.

Remote registration is available in Rhode Island. When sports betting in rhode island players must pay a 599 gambling tax on all winnings. Tax rates are built with the goal of getting each state enough revenue to deem sports betting worthwhile.

Heres a look at Rhode Islands sports betting history. Rhode Island has land-based sports betting that is legal to residents and tourists alike. Why Bet Anywhere Else.

Winnings of 300x. The 2020 fiscal year marked the debut of legal mobile sports betting in Rhode Island. Since then quite a few have come on board.

600 or more - the payor is obliged to provide you with a W-2G form. Sports Bet Rhode Island Revenue Split Breakdown. Twin River Casino and.

While it does not have this designation that essentially means Rhode Island set a 51 percent effective tax rate on sports. Gina Raimondo L with RI. Put simply for every 100 in sports betting revenue Twin Rivers keeps 17 while Rhode Island grabs 51.

Twin River has been the most popular of the two accounting for about three. Rhode Island was one of the first states in the US to offer sports betting launching in 2018 via retail outlets. House Speaker Nicholas Mattiello.

Read our detailed Rhode Island sports betting guide to learn where you can legally bet on sports in RI. In addition to paying taxes to the IRS you should include your sports betting winnings in your state income tax payments. Rhode island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting.

The first legal bet was wagered in-person in 2018 but mobile was added a year later. Thus the Ocean State will join the first wave of non-Nevada states to offer legal sports betting this year with a target. Learn all about the legal sports betting options and bonus offers available to you in Rhode Island in 2022.

While tax rates dont directly affect the odds they can come into play and thats why odds you may see in Nevada. Now lets focus more on explaining the vigorish tax persistent in every RI sports betting site. By 2020 the in-person stipulation was ended and players can register online for a new account.

Read the latest betting updates eligibility requirements. Nonetheless while sports betting is illegal in a large portion of the US this doesnt get you off the hook of paying taxes. The Supreme Court gave states the right to legalize sports betting in 2018.

Sports betting is legal in the state of rhode island. In 2019 they reported 178 million in revenue in 2019. Rhode Island Sports Betting Laws And Tax Rates.

Rhode Island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting. Further the IRS requires the state to impose an additional 24 federal tax on gambling earnings. Rhode Island Works Quickly The ink was barely dry on the Supreme Courts PASPA ruling when Rhode Island went all-in on sports.

All markets are covered including professional football basketball baseball and golf. Sports bettors no longer need to visit a retail sportsbook to verify. Is sports betting legal in Rhode Island.

Ad Bet Online With The Top Rated Sports Betting App Today. Heres how Rhode Island divvies up sports betting revenue. Find also a map of all land-based sportsbooks.

It is used by a great number of experienced punters to calculate the average fee a. Rhode Island Sports Betting Guide - Visit Online Gambling for the best RI sportsbooks of 2022. Delaware and Rhode Island both have a revenue-sharing model where revenue is shared between state casinos and operators.

Will Sports Betting Provide Significant Tax Revenue For Education Infrastructure Masslive Com

Sports Betting S Rapid Expansion Faces More Tests In 2020 Boston Herald

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Rhode Island Sports Betting Revenue Market Analysis

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

The Numbers Say Rhode Islanders Aren T Very Good At Sports Betting The Boston Globe

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Assessing State Sports Betting Structures Aaf

Finding A Beacon Hill Compromise On Sports Betting The Boston Globe

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

College Sports Betting In The Ohio Vs Massachusetts Bill Rhodeisland News

What Other States Can Learn From Rhode Island As Sports Betting Expands In 2020

Golocalprov Guess Who Is Not Allowed To Participate In Mobile Sports Betting

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

Best Rhode Island Sports Betting Apps In 2022 Ri Betting Apps Reviewed

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

U S Top 5 Earners For Sports Betting Tax Revenue By State In 2020 Gaming And Media