va home equity loan texas

This allows us to get you the best rates on all types of loan programs including. We work with more than 100 investors.

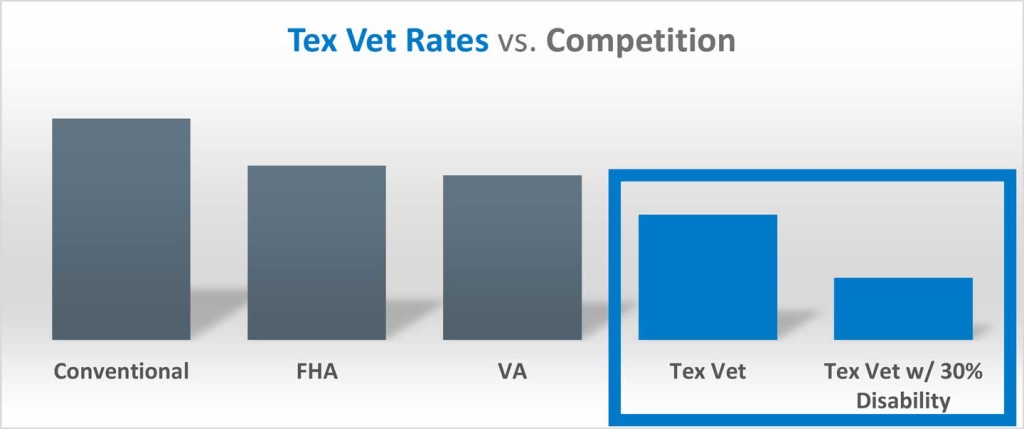

The Texas Veterans Home Loan I Didn T Know About Until I Became A Realtor

On a 200000 home the borrower has to pay 4600 to satisfy the expense.

. Viewed the same as a stick build traditional homes by lenders around the country this property style could allow you to save money decrease build time and get a great home at a cheaper rate than Manufactured Homes Eligible on our FHA VA Construction Loan ProgramPrefab Modular Homes are usually built. The advertised rates are based on certain assumptions and loan scenarios. While there is no official VA home equity loan there is a VA-backed program that can help you access cash through the equity in your property.

As part of our mission to serve you we provide a home loan guaranty benefit and other housing-related programs to help you buy build repair retain or adapt a home for your own personal occupancy. If you qualify you can also convert a. In turn lenders issue loans at superior terms.

30 Year fixed rate assumes a 400000 loan on a single family owner-occupied residence in California with a required minimum 740 FICO credit score and 50 loan to value with 275 Rate 295 APR and payments of 163296 per month for 360 Payments. The VA cash-out refinance program allows veterans and active-duty servicemembers to lower their interest rate while converting their home equity into cash. These types of loans are backed by the VA and are used by veterans to help them secure housing.

11 2020 and subject to. Any borrower without a current VA loan or who wants to take cash out of their homes equity must use the VA cash-out refinance. The only borrowers eligible for the VA IRRRL program are those with a current VA loan and who refinance only to lower their interest rate refinance from an ARM to a fixed-rate or to change the loans term.

Citation neededHome equity loans are often used to finance major expenses such as home repairs medical bills or college. For today Tuesday March 01 2022 the national average 30-year VA mortgage APR is 3710 up compared to last weeks of 3690. The VA cash-out refinance loan.

The VA home loan benefit is. In short a VA loan gives you the best of both worlds. Buy refinance or tap into home equity.

About Home Loans. When you want to get cash from your home equity with a VA loan we can often accept a minimum credit score as low as 550. As of 2021 a zero down payment VA loan for first-time applicants requires a funding fee of 23 of the homes appraised value according to VAgov.

The following examples describe the terms of a typical loan for rates available on Aug. As an honored service member active or not you still have options for locking down a VA home equity loan specifically the VA cash-out refinance loan program. While a great program for the buyer they can initially be a bit off-putting for sellers.

The VA home loan. Additional restrictions apply to Texas home equity loans. The VA doesnt have an official home equity loan program.

A home equity loan is a type of loan in which the borrower uses the equity of their home as collateralThe loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution. Once such type is the VA loan. The reason VA loans are able to charge a lower rate than other mortgages is the Veterans Administration guarantees to pay the lender up to 25 of the value of the home.

With a VA cash-out refinance you can refinance your current mortgage regardless of whether its a VA loan or a conventional loan and get cash by borrowing against the equity youve built. VA helps Servicemembers Veterans and eligible surviving spouses become homeowners. This loan allows you to take out a new VA mortgage for a larger amount than you currently owe providing the difference in cash.

But getting cash isnt the only reason to get a VA cash-out loan. 30yr mortgage 20yr mortgage 15yr mortgage 10yr mortgage 1yr ARMS 3yr ARMS 5yr ARMS Conventional Jumbo Home Equity Lines VA and Commercial. We offer VA IRRRL refinancing which lets you get a lower rate on your VA loan with less paperwork and a faster closing.

HELOCs are similar to home equity loans but instead of receiving the loan proceeds upfront you have a line of credit that you access during the loans draw period and repay during the repayment period. When you want to refinance a home with an VA loan we can often offer an easy credit score qualification. For many who qualify the VA loan program is the best possible mortgage.

Unlike a home equity loan a VA cash-out refinance replaces your existing mortgage rather than adding a second mortgage. 15 Year fixed rate assumes a 400000 loan on a single family owner-occupied residence with a. Unbeatable benefits for veterans.

When looking to sell your home there are a lot of different loans options a buyer might bring to the table. Todays national VA mortgage rate trends. You enjoy your benefit but have the convenience and speed of working with your chosen lender.

This means if a buyer bought a house for 500000 was foreclosed on the VA would cover the lender for any loses up to 125000. YES One-Time Close - True Prefabricated Modular Homes. A home equity line of credit HELOC is another option for using home equity to purchase a new home.

Texas Home Equity 12 Day Notice For Home Equity Loans Black Mann Graham L L P

When Should You Take Out A Home Equity Loan Vs Other Loans Mybanktracker

Va Mortgage Calculator Calculate Va Loan Payments

Home Equity Loans Pros And Cons Minimums And How To Qualify

If You Are Looking For Home Loans Broker Then You Can Go For Wedohomeloansforyou We Are Home Loan Specialists Mortgage Loans Refinance Mortgage Home Mortgage

Are There Va Home Equity Loans A Look At Options Lendingtree

Va Home Equity Loan Options Military Benefits

What Can You Buy With A Va Loan Va Loan Loan Loan Forgiveness

Home Equity And Heloc Loans Complete Guide

9 Best Va Loan Lenders Of February 2022 Money

The Northwest Number One Va Loan Specialists Mortgage Loan Calculator Home Loans Mortgage Loans

Va Home Equity Loans Best Options For Veterans Valuepenguin

Texas Home Equity Cash Out Refinance A6 Mortgagemark Com

7 Best Home Equity Loans Of 2021 Money

Va Loan For A Second Home How It Works Lendingtree

Can You Use Home Equity To Invest Lendingtree

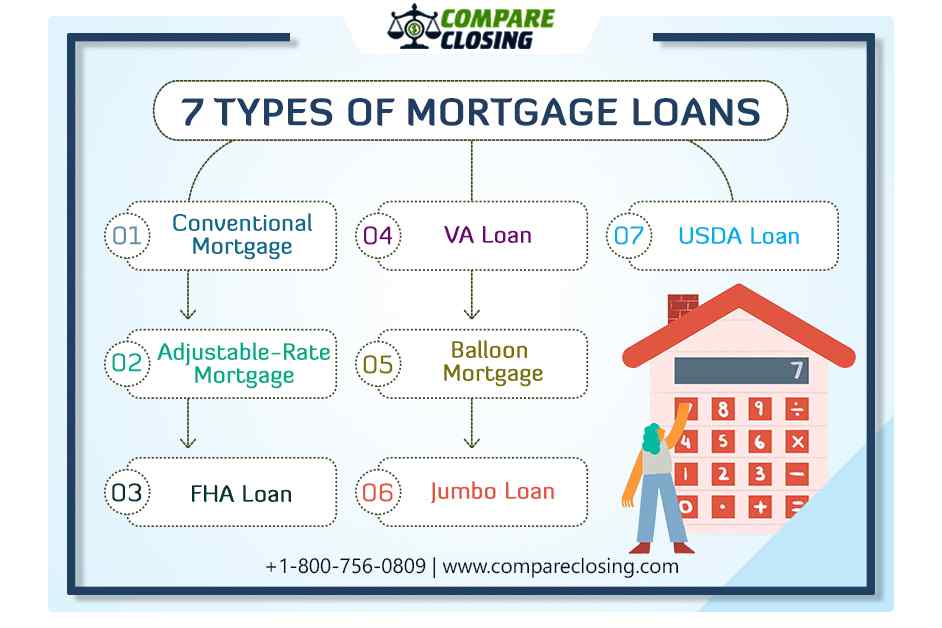

7 Best Types Of Mortgage Loans In Texas For Homebuyers

Va Cash Out Refinance Loan 2021 Guidelines And Information

Va Refinance How To Refinance A Conventional Mortgage To Va Loan