nh meals tax form

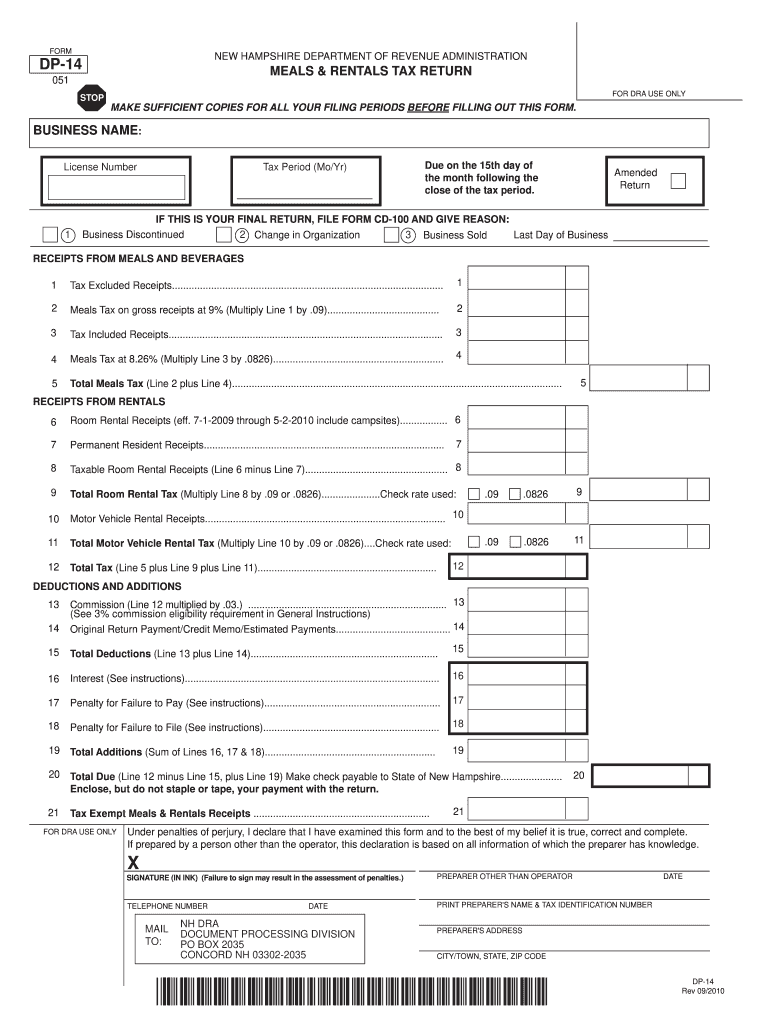

Final bobsled runs and pairs free skate in figure skating AP. RSA 78-A4 requires each owneroperator to register with the Department prior to opening a hotel offering sleeping accommodations selling taxable meals or renting motor vehicles by applying for a Meals Rentals Tax License.

I have reasonably estimated the fair market value of each asset.

. This is a Tribute Gift. To the best of my knowledge and belief I have fully disclosed all income and all assets having any substantial value. Exemption extends to goods meals services and room occupancies.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. NHES Employer Job Match System. Uniform Commercial Code UCC Filing and Searching.

Additional fees apply for Earned. Multiply amount in line 10 by the rate shown. The statutes for collection are provided by RSA 72 of the New Hampshire Statutes Annotated.

35 50 100 250 500 1000 Enter amount. According to the Energy Information Administration New Hampshires energy consumption and per capita. To be used as a restaurant this storefront needs to be plumbed and wired.

The site consists of a 20 x 20 square-foot dining room a 15 x 15 square-foot kitchen two bathrooms and a storage room in back. As such for license renewal beginning in May of each. New Hampshire NH x Not exempt from rooms and meals tax.

The issue of taxation is controversial in New Hampshire which has a property tax subject to municipal control but no broad sales tax or income tax. Meals and Rental Tax Returns and Payments Online. NHES Web Tax Application.

Legal-Courts Hillarys campaign paid for high-tech spying on Trump even after the election says Durham. TOTAL TAX DUE - The total of lines 11 and 12 is the total tax due to the State of NH. The state collects thirty-four percent of its revenue from business taxes and another twelve percent from Meals and Rooms Taxes also known as our rentals tax.

ADMINISTRATIVE CONTRIBUTION AC DUE. Joe Bidens national security adviser Jake Sullivan may have some explaining to do during his next press conference. Check here if parties agree to waive Monthly Expenses form.

Select a Gift Duration. Type of federal return filed is based on your personal tax situation and IRS rules. Do not include this portion of your payment on your FUTA form Line 13.

School to Work Application. 940 EZ Federal Unemployment Tax Return - FUTA Line 12. Russia could be cut off from markets tech goods AP.

And it might involve his own role in perpetuating the Democrats myth about Donald Trumps alleged collusion with the Russians. New Mexico NM x Only exemption. We would no longer have free trade within the worlds largest consumer market.

Questions as to amounts owed interest accrued date of payments etc may be addressed to the Tax Collector. Because it is the Board of Selectmen that determines who is taxed and for what amount it is to that office that questions concerning taxation must be addressed. 1 any remuneration other than an excess parachute payment in excess of 1 million paid to a covered employee by an applicable tax-exempt organization for a taxable year and 2 any excess parachute payment separation pay as specified in the bill.

2020 Tax Rate Breakdown Applications for Abatement of 2020 Taxes will be accepted until March 1 2021 Applications for Exemptions or Credits for 2021 must be filed by April 15 2021. Tax Return Information Year of last return filed Single or joint return My. These two state taxes overwhelmingly make up our revenue stream and would be impacted if we left the Union.

You can deliver health and hope with a gift today. Additional Information I swear affirm that. This article has been updated to reflect updates to the Child and Dependent Care Credit from the American Rescue Plan Act of 2021Youll find those details near the bottom of this page.

The Moose Mountain Café will be located at 200 Main Street Moose Mountain NH with seating for 20 patrons. This law also states that the registrationlicense expires on June 30th in each odd numbered year. If youre a parent or caretaker of disabled dependents or spouses listen upyou may qualify for a special tax credit used for claiming child care expenses.

Users may rely on this list in determining deductibility of their contributions. Example line 10 Taxable wages 1400000. Request for Payment of Wages Other Than Weekly Form.

New Jersey NJ Provide vendor copy of State of New Jersey Exempt Organization Certificate ST-5 PDF Exempt Organization Number 030-179-440000 Effective Date 12201993 Issue Date 01022002. Town of Stratham 10 Bunker Hill Avenue Stratham NH 03885 603 772-4741 Town Employee Information Website Disclaimer Government Websites by CivicPlus Login. Organizations whose federal tax-exempt status was automatically revoked for not filing a Form 990-series return or notice for three consecutive years.

The rent is 600 a month with a five-year lease available. Organizations eligible to receive tax-deductible charitable contributions. Box 1105 Portsmouth NH 03802.

Food Friends provides nurtionally tailored meals to seriously-ill neighbors in need connecting them to community and helping them to heal. Via phone at 603-452-PLAN or e. The state does have narrower taxes on meals lodging vehicles business and investment income and tolls on state roads.

The tax is equal to the product of the corporate tax rate 21 under this bill and the sum of. Guidelines for nominating deserving individuals andor companies may be obtained by contacting the awards steward Plan NH at PO. Choose NH Real Estate Database.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. Field Is Required Donation Amount.

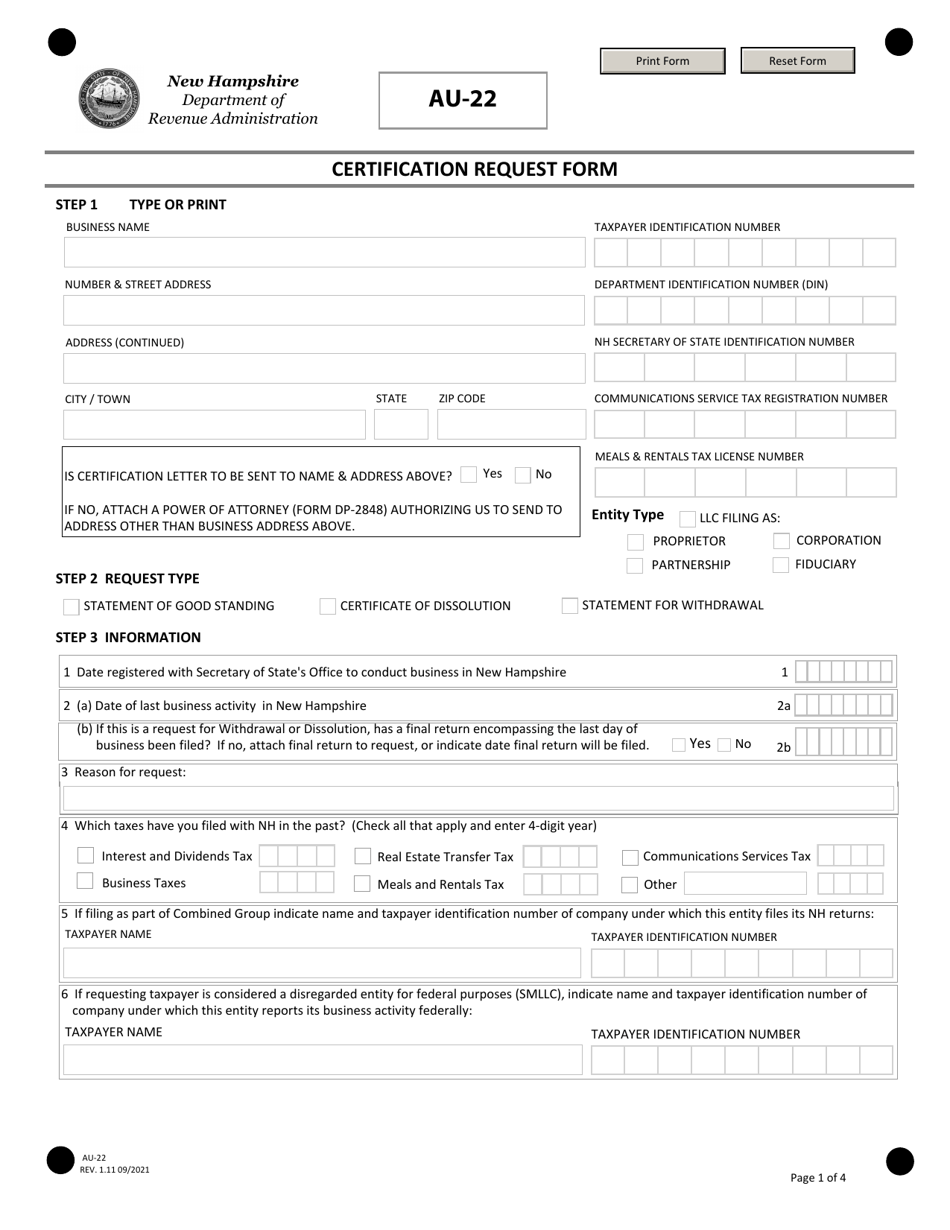

Form Au 22 Download Fillable Pdf Or Fill Online Certification Request Form New Hampshire Templateroller

Facilities Campground Crow S Nest Lake Sunapee

2019 Form Nh Dor Dp 14 Fill Online Printable Fillable Blank Pdffiller

Nh Dor Dp 14 2010 Fill Out Tax Template Online Us Legal Forms

Facilities Campground Crow S Nest Lake Sunapee

Real Estate Transfer Declaration Of Consideration For Holding Compani

Contract For Catering Services Template Awesome Catering Contract Template Free Documents For Contract Template Templates Pop Up Card Templates

Bank Wire Transfer Form Bank Wire Form Bank Personal Information Personal Info On Form Marketing Graphics Bank Of America Bank

Amazon To Launch New Grocery Store Business Food Store Whole Food Recipes Grocery

Keene Nh Pumpkin Festival So Many Pumpkins Lit All At Once World Records Baby Pumpkin Lights Pumpkin Festival World

Construction Accounting Software Quickbooks Accounting Software Accounting

Maintaining Camper Seals Truck Camper Truck Camper Magazine Truck Campers For Sale

How To Freeze Spring Onions Storing Green Onions Scallions Spiceindiaonline Spring Onion Green Onions Onion

I 9 Form Printable I9 Form Fill Online Printable Fillable Blank Pdffiller I 9 Form Linear Function Passport Application Form

Bank Wire Transfer Form Bank Wire Form Bank Personal Information Personal Info On Form Marketing Graphics Bank Of America Bank

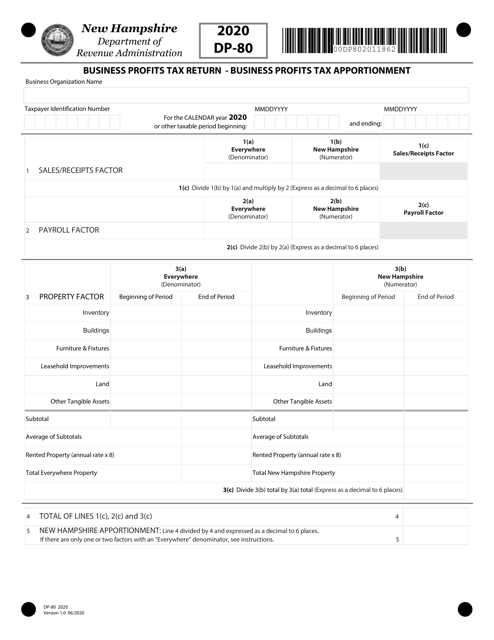

Form Dp 80 Download Fillable Pdf Or Fill Online Business Profits Tax Return Business Profits Tax Apportionment 2020 New Hampshire Templateroller